There will be plenty of fanfare for how well the sports betting industry fared in 2024 – and with good reason, as handle, revenue, and tax income records fell across the country.

But for all the enthusiasm sportsbooks had going into the NFL season, a couple of big months for the public resulted in dramatically lower figures in terms of both gross revenue and tax revenue – and the reverberations of these developments were felt in every state and by every sports betting site.

Here's a detailed breakdown of the 2024 numbers:

U.S. Sports Betting Handle 2024

| Month | 2023 | 2024 | Change |

|---|---|---|---|

It's particularly notable that the summer months saw the greatest year-over-year lift in handle, with increased interest in the WNBA, the Summer Olympics in Paris, and soccer's European Championships likely fueling that growth.

U.S. Sports Betting Gross Revenue 2024

| Month | 2023 | 2024 | Change |

|---|---|---|---|

As great as it is from a sportsbook revenue perspective to see such strong numbers over the first nine months of 2024, the real story is where the numbers land for October and December, both of which were historically terrific months for the betting public (and a truly terrible pair of 31-day stretches for the books).

U.S. Sports Betting Hold 2024

| Month | 2023 | 2024 | Change |

|---|---|---|---|

When the favorites win, the sportsbooks lose – and that proved to be the theme of 2024, particularly where the monthly hold rates were concerned.

March Madness was much chalkier in 2024 than it was a year earlier, resulting in a much weaker take for the sportsbooks. And October and December were a bettor's delight (and a sports betting site's nightmare), as NFL bettors took sports betting sites to the cleaners.

U.S. Sports Betting Tax Revenue 2024

| Month | 2023 | 2024 | Change |

|---|---|---|---|

A massive summer gave way to an underwhelming fall. The year is still considered a success based on the year-over-year growth, but both governments and sports betting sites have been left wondering what could have been.

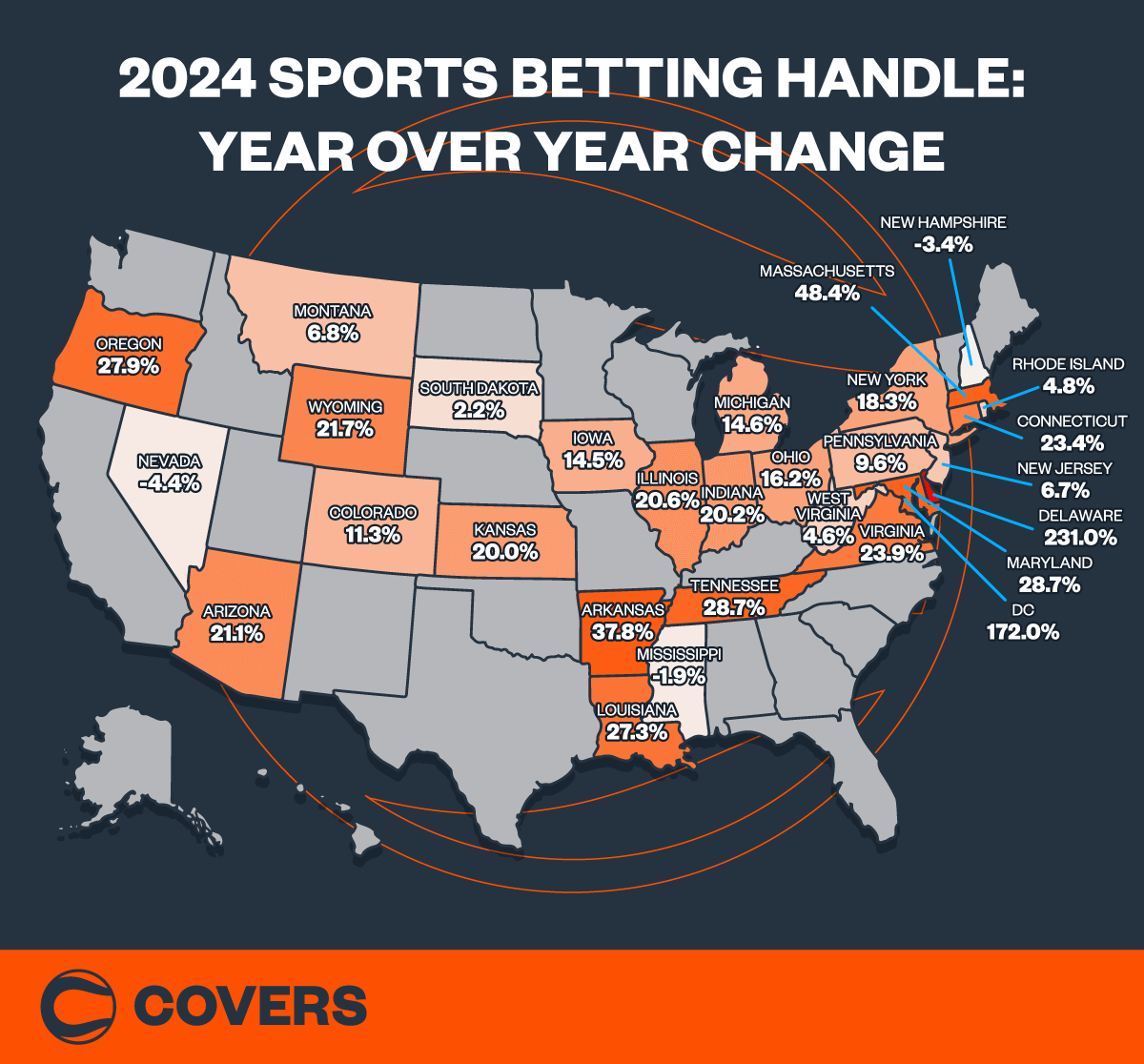

Top 10 States in 2024 Sports Betting Handle

| Rank | State | 2024 Handle | YoY Change |

|---|---|---|---|

| 1 | New York | $22.7 billion | ▲ 18.3% |

| 2 | Illinois | $14.0 billion | ▲ 20.6% |

| 3 | New Jersey | $12.8 billion | ▲ 6.7% |

| 4 | Ohio | $8.8 billion | ▲ 16.2% |

| 5 | Pennsylvania | $8.4 billion | ▲ 9.6% |

| 6 | Arizona | $8.0 billion | ▲ 21.1% |

| 7 | Nevada | $7.9 million | ▼ 4.4% |

| 8 | Massachusetts | $7.4 billion | ▲ 48.4% |

| 9 | Virginia | $6.9 billion | ▲ 23.9% |

| 10 | Colorado | $6.2 billion | ▲ 11.3% |

New York remains the gold standard for U.S. sports betting handle, even with a sky-high tax rate and steep competition from all of the industry's major players.

The majority of states that populate the other nine spots on this list are probably where you would expect to find them. New Jersey has long been considered the biggest gambling hotspot outside of Nevada, while Illinois, Ohio and Pennsylvania are all home to some of the most rabid fan bases in sports.

The one outlier: Virginia, which sits among several prolific sports states but has no major professional team itself.

2024 Sports Betting Revenue Report By State

Arizona

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $6.6 billion | $8.0 billion | ▲ 21.1% |

| Gross Revenue | $557.4 million | $707.7 million | ▲ 27.0% |

| Hold Rate | 9.2% | 8.9% | ▼ 3.3% |

| Tax Revenue | $34.8 million | $42.7 million | ▲ 22.7% |

Monthly Highs

- Handle: $897.6 million (November)

- Gross Revenue: $86.3 million (November)

- Hold Rate: 11.0% (May)

- Tax Revenue: $5.7 million (November)

Consistently among the last states to release its monthly numbers, Arizona came in noticeably close to the national averages in both handle and gross revenue for 2024.

Arizona sports betting is among the most active markets in the U.S., exceeding $500 million in total wagers in nine of 12 months last year with a high-water mark approaching $900 million in November. And while it saw its yearly hold dip slightly compared to 2023, all that action meant new records for sportsbook and tax revenues.

Arkansas

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $404.8 million | $557.9 million | ▲ 37.8% |

| Gross Revenue | $37.2 million | $48.2 million | ▲ 29.6% |

| Hold Rate | 9.2% | 8.6% | ▼ 6.5% |

| Tax Revenue | $4.2 million | $7.1 million | ▲ 70.5% |

Monthly Highs

- Handle: $66.1 million (November)

- Gross Revenue: $9.2 million (November)

- Hold Rate: 13.9% (November)

- Tax Revenue: $1.2 million (November)

Arkansas sports betting saw significant year-over-year lift in all the major categories in 2024, generating nearly 38% more betting handle while exceeding 2023 tax revenue by a whopping 70.5%.

The year would have been even better were it not for mighty NFL struggles in October and December that plagued the majority of state. Arkansas managed a meager 5.2% hold rate in October, and came in with a 2.7% hold in December – its lowest for a single month since June 2022.

Colorado

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $5.6 billion | $6.2 billion | ▲ 11.3% |

| Gross Revenue | $391.9 million | $475.2 million | ▲ 21.2% |

| Hold Rate | 7.0% | 7.7% | ▲ 10.0% |

| Tax Revenue | $27.4 million | $31.9 million | ▲ 16.4% |

Monthly Highs

- Handle: $648.4 million (December)

- Gross Revenue: $55.7 million (November)

- Hold Rate: 10.2% (July)

- Tax Revenue: $4.1 million (January)

The Colorado sports betting picture was a mixed bag in 2024, as revenues grew decently despite only a modest increase in handle.

Colorado's vastly competitive sports betting market took it on the chin repeatedly last year, recording handle below 7% in four different months (including a 4.8% rate in February and a 4.6% hold in December). The state is off to a great start in 2025, but the lingering thought of what could have been still haunts sports betting sites.

Connecticut

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $1.7 billion | $2.2 billion | ▲ 23.4% |

| Gross Revenue | $182.2 million | $221.0 million | ▲ 21.2% |

| Hold Rate | 10.3% | 10.2% | ▼ 0.9% |

| Tax Revenue | $19.5 million | $26.1 million | ▲ 33.5% |

Monthly Highs

- Handle: $233.0 million (December)

- Gross Revenue: $30.7 million (November)

- Hold Rate: 13.5% (November)

- Tax Revenue: $3.5 million (November)

Connecticut put up record numbers, but the state must be wondering what could have been after posting an incredibly dismal December take. Connecticut sports betting generated a paltry $3.7 million in revenue over the final month of 2024 – nine times lower than its November take – while posting a paltry 1.9% hold rate.

Still, it's hard to quibble with the overall results, which saw handle climb by nearly $400 million and tax revenue soar to more than $26 million.

Delaware

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $65.3 million | $216.0 million | ▲ 231% |

| Gross Revenue | $10.9 million | $16.4 million | ▲ 50.3% |

| Hold Rate | 16.7% | 7.6% | ▼ 54.5% |

| Tax Revenue | $8.4 million | $9.6 million | ▲ 13.2% |

Monthly Highs

- Handle: $28.4 million (December)

- Gross Revenue: $3.2 million (September)

- Hold Rate: 13.9% (September)

- Tax Revenue: $2.2 million (September)

How does a state more than triple its year-over-year sports betting handle yet generate just 13.2% more tax revenue?

Here's how it happened: While Delaware sports betting far exceeded its 2023 benchmarks, punters were far more successful; the state averaged a 16.7% monthly hold last year, but didn't exceed that mark once in 2024. The 0.4% hold rate in December was the rotten cherry on top of a melted sundae for Delaware operators.

District of Columbia

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $169.8 million | $461.6 million | ▲ 172% |

| Gross Revenue | $19.0 million | $53.7 million | ▲ 182% |

| Hold Rate | 11.2% | 11.6% | ▲ 3.5% |

| Tax Revenue | $5.4 million | $16.3 million | ▲ 201% |

Monthly Highs

- Handle: $68.3 million (November)

- Gross Revenue: $9.0 million (November)

- Hold Rate: 15.3% (May)

- Tax Revenue: $2.9 million (May)

Increased competition wasn't just the best thing about D.C. sports betting in 2024 – it was the only thing.

Ending FanDuel's monopoly within the district and opening the gates to every other major sports betting operator provided a welcome boon for both sportsbooks and the government, which saw its tax revenue triple year-over-year. D.C. also weathered the NFL storm nicely, finishing as one of the only states to see its hold rate rise in 2024.

Illinois

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $11.6 billion | $14.0 billion | ▲ 20.6% |

| Gross Revenue | $1.0 billion | $1.2 billion | ▲ 19.2% |

| Hold Rate | 8.7% | 8.6% | ▼ 1.1% |

| Tax Revenue | $161.0 million | $276.5 million | ▲ 71.7% |

Monthly Highs

- Handle: $1.5 billion (November)

- Gross Revenue: $155.9 million (November)

- Hold Rate: 10.3% (September)

- Tax Revenue: $49.7 million (November)

Chicago-area bettors came out in full force in 2024, pushing Illinois sports betting handle just north of $14 billion for the year – and that resulted in shattered records across the majority of annual sports betting metrics.

The state recorded nine months with billion-dollar handle, surpassing the $1.4 billion mark in each of the final three months of the year. And while Illinois only saw four months with double-digit hold, it withstood those October and December chills better than most states.

Indiana

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $4.4 billion | $5.2 billion | ▲ 20.2% |

| Gross Revenue | $404 million | $485 million | ▲ 19.9% |

| Hold Rate | 9.3% | 9.3% | -- |

| Tax Revenue | $38.4 million | $46.2 million | ▲ 20.4% |

Monthly Highs

- Handle: $614.4 million (November)

- Gross Revenue: $68.8 million (November)

- Hold Rate: 11.4% (September)

- Tax Revenue: $6.5 million (November)

Caitlin Clark probably doesn't deserve all the credit here, but it's clear that her emergence as a women's basketball powerhouse (in more ways than one) has had a significant positive impact on the Indiana sports betting scene.

Clark and the Fever saw significant betting action throughout the 2024 season, helping boost the state's handle, revenue, and tax take by approximately 20% across the board. Those increases came despite a flat year-over-year hold, which is still better than some states will see as the 2024 numbers fill out.

Iowa

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $2.4 billion | $2.8 billion | ▲ 14.5% |

| Gross Revenue | $198.8 million | $218.5 million | ▲ 9.9% |

| Hold Rate | 8.2% | 7.9% | ▼ 3.7% |

| Tax Revenue | $13.4 million | $14.5 million | ▲ 9.9% |

Monthly Highs

- Handle: $315.2 million (November)

- Gross Revenue: $30.1 million (November)

- Hold Rate: 10.1% (September)

- Tax Revenue: $2.0 million (November)

While Clark's WNBA landing spot reaped the benefits of her arrival from a sports betting handle perspective, her collegiate home fared quite well, too.

Iowa's run to the 2024 Women's National Championship game proved to be a boon for Iowa sports betting, which took in a record $272 million in handle (a mark that was subsequently beaten in October, then again in November). That contributed to healthy increases in handle, revenue, and tax take despite a slight dip in hold rate.

Kansas

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $2.1 billion | $2.5 billion | ▲ 20.0% |

| Gross Revenue | $182.4 million | $216.7 million | ▲ 18.8% |

| Hold Rate | 8.6% | 8.5% | ▼ 1.2% |

| Tax Revenue | $10.0 million | $12.7 million | ▲ 27.0% |

Monthly Highs

- Handle: $291.0 million (November)

- Gross Revenue: $34.8 million (November)

- Hold Rate: 13.7% (September)

- Tax Revenue: $2.6 million (November)

2024 saw standard year-over-year increases for Kansas sports betting proprietors, which had to be a welcome relief – as was a much more stable showing in terms of month-to-month fluctuations.

Gone are the negative-revenue months like Kansas experienced in February 2023, though the state did fall below 5% in hold twice in 2024 (February and October). Kansas managed to finish with a relatively flat hold rate year-over-year thanks to double-digit showings in five separate months.

Kentucky*

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | N/A | $2.6 billion | N/A |

| Gross Revenue | N/A | $278.8 million | N/A |

| Hold Rate | N/A | 10.6% | N/A |

| Tax Revenue | N/A | $38.6 million | N/A |

*launched in September 2023

Monthly Highs

- Handle: $301.6 million (November)

- Gross Revenue: $36.6 million (November)

- Hold Rate: 14.6% (January)

- Tax Revenue: $5.0 million (November)

Few states escaped 2024 with a double-digit hold rate for the year – but Kentucky sports betting met the challenge in its first full year of operation.

The state fared impressively in October and December, finishing with hold rates of 7.7% and 7.4%, respectively – and when you add in double-digit showings in seven of the other 10 months, it's easy to see why Kentucky exceeded expectations in Year 1.

Louisiana

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $2.9 billion | $3.7 billion | ▲ 27.3% |

| Gross Revenue | $367.3 million | $467.1 million | ▲ 27.2% |

| Hold Rate | 12.6% | 12.6% | -- |

| Tax Revenue | $43.5 million | $65.1 million | ▲ 49.7% |

Monthly Highs

- Handle: $413.5 million (November)

- Gross Revenue: $58.2 million (November)

- Hold Rate: 15.7% (September)

- Tax Revenue: $8.2 million (November)

Betting is still big on the Bayou, with Louisiana sports betting taking in record handle and revenue for the year.

Most states can only dream of the kind of consistency Louisiana showed in its hold rates, which only slipped below 10% in one month (I'll give you one guess as to which one it was). A strong November and decent December put a cap on a fantastic year for Louisiana sportsbooks overall.

Maine*

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | N/A | $520.0 million | N/A |

| Gross Revenue | N/A | $53.4 million | N/A |

| Hold Rate | N/A | 10.3% | N/A |

| Tax Revenue | N/A | $5.5 million | N/A |

*launched in November 2023

Monthly Highs

- Handle: $52.2 million (December)

- Gross Revenue: $7.9 million (November)

- Hold Rate: 15.4% (November)

- Tax Revenue: $790,413 (November)

We only have two months of 2023 data on the Maine sports betting front, but the year-over-year increases across November and December (a combined 26.5% across both months) suggest that 2024 was a highly successful month for the state.

Maine's double-digit handle stands out here, and you can expect it to be even higher in 2025 as parlays continue to grow as a share of total handle and NFL revenue expected to bounce back on some level following an unusually chalky 2024 showing.

Maryland

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $4.6 billion | $5.9 billion | ▲ 28.7% |

| Gross Revenue | $514.1 million | $635.7 million | ▲ 23.7% |

| Hold Rate | 11.1% | 10.7% | ▼ 3.6% |

| Tax Revenue | $46.2 million | $82.3 million | ▲ 78.2% |

Monthly Highs

- Handle: $639.9 million (November)

- Gross Revenue: $82.3 million (November)

- Hold Rate: 13.1% (July)

- Tax Revenue: $11.8 million (November)

You can't attribute the success of a state's local teams solely to sports betting growth – but it certainly didn't hurt the Maryland sports betting scene that the state's pro sports franchises were mostly really good in 2024.

Both the Washington Commanders and the Baltimore Ravens have advanced to the divisional round of the NFL playoffs, while the Orioles won 91 games and narrowly missed the playoffs. Even the NHL's Washington Capitals, who play in nearby D.C. but have a huge Maryland following, have excelled as one of the top teams in the league in 2024-25.

Massachusetts

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $5.0 billion | $7.4 billion | ▲ 48.4% |

| Gross Revenue | $483.5 million | $671.4 million | ▲ 38.9% |

| Hold Rate | 9.7% | 9.1% | ▼ 6.2% |

| Tax Revenue | $93.8 million | $130.2 million | ▲ 38.8% |

Monthly Highs

- Handle: $784.2 million (December)

- Gross Revenue: $82.6 million (November)

- Hold Rate: 11.1% (September)

- Tax Revenue: $16.0 million (November)

Year 2 of Massachusetts sports betting exceeded just about every expectation – and hopes were already high to begin with.

After falling tantalizingly short of the $5 billion barrier in handle in its first year of operation, the notoriously stringent Massachusetts sports betting scene vaulted to new heights in 2024, clearing $7 billion in action thanks to a new monthly record for December. Hold rate fell, but the sheer volume of wagers resulted in a measurable boost in betting and tax revenue.

Michigan

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $4.8 billion | $5.5 billion | ▲ 14.6% |

| Gross Revenue | $434.4 million | $470.3 million | ▲ 8.3% |

| Hold Rate | 9.0% | 8.5% | ▼ 5.6% |

| Tax Revenue | $23.6 million | $21.2 million | ▼ 10.1% |

Monthly Highs

- Handle: $671.2 million (November)

- Gross Revenue: $60.2 million (November)

- Hold Rate: 12.1% (May)

- Tax Revenue: $2.7 million (November)

After smashing yearly records across the board in 2023, Michigan sports betting saw muted growth (and even a drop in total tax revenue) last year.

In addition to taking its lumps in October and December (similar to the majority of states with legal sports betting), Michigan saw flat tax revenue from March through May, traditionally one of the more lucrative stretches of the year both the sportsbooks and the government. If the Tigers and Lions see a dip in performance, things could get even uglier.

Mississippi

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $474.3 million | $465.0 million | ▼ 1.9% |

| Gross Revenue | $51.2 million | $40.0 million | ▼ 21.8% |

| Hold Rate | 10.8% | 8.6% | ▼ 20.4% |

| Tax Revenue | $6.1 million | $4.8 million | ▼ 21.8% |

Monthly Highs

- Handle: $57.9 million (November)

- Gross Revenue: $8.0 million (November)

- Hold Rate: 14.1% (August)

- Tax Revenue: $965,832 (November)

Most legal betting jurisdictions were able to ride out the NFL storm and show year-over-year improvement. Mississippi sports betting wasn't as fortunate.

Monthly handle was stagnant for the majority of 2024, and the accompanying drop of more than 20% in hold was just too much for the Mississippi sportsbooks to overcome. December was the low point, as the state saw a -1.5% hold and negative tax revenue of more than $100,000 – the first time that has happened since June 2020.

Montana

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $62.3 million | $66.5 million | ▲ 6.8% |

| Gross Revenue | $8.4 million | $7.1 million | ▼ 15.6% |

| Hold Rate | 13.6% | 10.7% | ▼ 22.8% |

| Tax Revenue | $1.3 million | $291,613 | ▼ 78.2% |

Monthly Highs

- Handle: $7.6 million (October)

- Gross Revenue: $1.6 million (November)

- Hold Rate: 21.5% (November)

- Tax Revenue: $510,561 (November)

Few states experience crazier swings in hold and tax revenue than Montana, which saw dramatic highs and lows in 2024.

Residents of Big Sky Country raided sports betting coffers with impunity, leading to four months where the state finished with negative tax revenue (including a staggering -$471,621 as the result of an October bloodbath.) On the flip side, Montana also produced holds of 19% or higher in three different months, highlighted by a very lucrative November.

Nevada

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $8.3 billion | $7.9 million | ▼ 4.4% |

| Gross Revenue | $481.4 million | $482.1 million | ▲ 0.1% |

| Hold Rate | 5.8% | 6.1% | ▲ 5.2% |

| Tax Revenue | $32.5 million | $32.5 million | ▲ 0.2% |

Monthly Highs

- Handle: $837.9 million (November)

- Gross Revenue: $80.9 million (September)

- Hold Rate: 10.6% (September)

- Tax Revenue: $5.5 million (September)

Is the sports betting OG losing its luster as the prime destination for U.S. sports bettors? The 2024 numbers suggest that Nevada sports betting has been knocked down a notch.

While the state saw a modest lift in year-over-year hold rate (thanks largely to a 10.6% showing in September), it failed to capitalize on two of the biggest wagering events on the sports calendar. March saw a dismal 3.8% hold rate, while Nevada was also victimized by public NFL beatings in October (3.6%) and December (1.8%).

New Hampshire

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $821.7 million | $793.4 million | ▼ 3.4% |

| Gross Revenue | $80.3 million | $79.1 million | ▼ 1.5% |

| Hold Rate | 9.8% | 10.0% | ▲ 2.0% |

| Tax Revenue | $35.6 million | $34.9 million | ▼ 2.0% |

Monthly Highs

- Handle: $87.3 million (November)

- Gross Revenue: $10.5 million (November)

- Hold Rate: 13.4% (January)

- Tax Revenue: $4.6 million (November)

It was a mostly hum-drum year for the New Hampshire sports betting scene, with numbers ever-so-slightly down across the board compared with 2023.

Handle grew modestly during the 2024 NFL season, and the state's sports betting sites did well to avoid getting throttled in October (7.4% hold) and December (9.2%). But a drop of more than $30 million in March handle essentially set the tone for what was a largely underwhelming 2024.

New Jersey

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $12.0 billion | $12.8 billion | ▲ 6.7% |

| Gross Revenue | $1.0 billion | $1.1 billion | ▲ 8.7% |

| Hold Rate | 8.4% | 8.6% | ▲ 2.4% |

| Tax Revenue | $141.5 million | $154.8 million | ▲ 9.4% |

Monthly Highs

- Handle: $1.72 billion (January)

- Gross Revenue: $170.8 million (January)

- Hold Rate: 12.3% (July)

- Tax Revenue: $24.2 million (January)

Momentum was high for New Jersey sports betting on the strength of a record-setting January – but the Garden State just couldn't keep the good times going.

While the state did slightly surpass last year's figures across the board, those lifts came despite a rough showing during the NFL season, with handle decreasing every month from September to December and hold rates shrinking below 7% in both October and December. Has New Jersey reached its sports betting zenith? We'll see what 2025 has in store.

New York

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $19.2 billion | $22.7 billion | ▲ 18.3% |

| Gross Revenue | $1.7 billion | $2.0 billion | ▲ 20.7% |

| Hold Rate | 8.8% | 9.0% | ▲ 2.2% |

| Tax Revenue | $861.5 million | $1.0 billion | ▲ 21.1% |

Monthly Highs

- Handle: $2.3 billion (October)

- Gross Revenue: $232.2 million (November)

- Hold Rate: 11.1% (July)

- Tax Revenue: $118.2 million (November)

The Empire State lived up to its moniker yet again in 2024, producing some truly stratospheric numbers even despite falling well short of NFL revenue projections.

New York sports betting produced a staggering $22.7 billion in handle for the year, and its $2+ billion in gross revenue and $1+ billion in tax revenue are new single-year benchmarks that no other state has come close to reaching. Just imagine how much greater the take will be when the Jets and Giants field competitive rosters.

North Carolina

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | NA | $5.4 billion | NA |

| Gross Revenue | NA | $583.6 million | NA |

| Hold Rate | NA | 10.8% | NA |

| Tax Revenue | NA | $96.8 million | NA |

Monthly Highs

- Handle: $657.2 million (March)

- Gross Revenue: $105.3 million (April)

- Hold Rate: 16.4% (April)

- Tax Revenue: $15.8 million (April)

North Carolina sports betting had a wildly successful first 10 months by any measure – and the best might very well be yet to come.

While the state peaked early with staggering performances in March and April, bettors kept flocking the app throughout the summer (generating $1.1 billion in handle from June through August) and hit the $600 million mark in each of the final three months of the calendar year. Expect even bigger numbers in Year 2, thanks to a full year of reporting.

Ohio

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $7.6 billion | $8.8 billion | ▲ 16.2% |

| Gross Revenue | $934.2 million | $899.7 million | ▼ 3.7% |

| Hold Rate | 12.3% | 10.2% | ▼ 17.1% |

| Tax Revenue | $133.3 million | $181.0 million | ▲ 35.8% |

Monthly Highs

- Handle: $1.0 billion (November)

- Gross Revenue: $117.1 million (November)

- Hold Rate: 14.1% (January)

- Tax Revenue: $23.5 million (November)

It was a strange year on the Ohio sports betting scene – and how well it turned out depends solely on which group of stakeholders you ask.

Ohio sports betting operators were left disappointed as they saw a modest drop in gross revenue brought about by a massive dip in hold rate (though in fairness, that 2023 figure was a long shot to be replicated last year). The government, however, had to be pleased with a year-over-year increase of nearly $50 million in tax revenue.

Oregon

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $675.9 million | $864.7 million | ▲ 27.9% |

| Gross Revenue | $75.7 million | $94.4 million | ▲ 24.7% |

| Hold Rate | 11.2% | 10.9% | ▼ 2.7% |

| Tax Revenue | $37.9 million | $47.2 million | ▲ 24.7% |

Monthly Highs

- Handle: $90.2 million (December)

- Gross Revenue: $11.9 million (November)

- Hold Rate: 15.1% (September)

- Tax Revenue: $5.9 million (November)

You can chalk up Oregon's massive year-over-year gains to the same factors that have impacted every other state – and throw in a little extra thanks to the Ducks' success.

While the NCAA football season didn't end with a national championship, the Ducks securing the No. 1 ranking for the final two months of the regular season certainly gave bettors and fans plenty of reason to support the team down the stretch. That goes a long way toward explaining why Oregon sports betting saw a nearly 25% jump in gross and tax revenue, and a 28% increase in overall handle for the year.

Pennsylvania

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $7.7 billion | $8.4 billion | ▲ 9.6% |

| Gross Revenue | $686.9 million | $778.4 million | ▲ 13.3% |

| Hold Rate | 8.9% | 9.2% | ▲ 3.3% |

| Tax Revenue | $165.1 million | $183.9 million | ▲ 11.3% |

Monthly Highs

- Handle: $935.5 million (November)

- Gross Revenue: $103.3 million (November)

- Hold Rate: 12.7% (July)

- Tax Revenue: $27.8 million (November)

The lift wasn't quite where Pennsylvania sports betting operators and the state government would have liked, but pulling in nearly $800 million in revenue and generating $184 million in tax funds can hardly be considered a disappointment.

The Keystone State came close to its first $1 billion month in November, but reached a different benchmark by recording its first nine-figure gross revenue total for the month. The success of the Philadelphia Eagles should also mean a terrific start to 2025 as the state looks to top the $858 million in wagers it generated in January 2024.

Rhode Island

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $461.3 million | $483.5 million | ▲ 4.8% |

| Gross Revenue | $40.3 million | $37.9 million | ▼ 6.0% |

| Hold Rate | 8.7% | 7.8% | ▼ 10.3% |

| Tax Revenue | $20.5 million | $19.3 million | ▼ 6.0% |

Monthly Highs

- Handle: $50.6 million (November)

- Gross Revenue: $5.3 million (September)

- Hold Rate: 12.1% (September)

- Tax Revenue: $2.6 million (September)

Rhode Island sports betting continues to tread water, and you have to wonder if the state has already peaked.

The smallest U.S. state by area saw a micro-increase in handle but experienced drops in all other major categories. Gross revenue slipped by nearly $2.5 million, while the state generated $1.2 million less in tax revenue. And December was a fitting capper to a difficult year, producing a dismal 2.3% hold and just $584,113 in tax earnings.

South Dakota

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $9.0 million | $9.2 million | ▲ 2.2% |

| Gross Revenue | $1.0 million | $776,042 | ▼ 23.2% |

| Hold Rate | 11.2% | 8.4% | ▼ 25.0% |

| Tax Revenue | $72,536 | $69,843 | ▼ 3.7% |

Monthly Highs

- Handle: $1.2 million (March)

- Gross Revenue: $215,820 (September)

- Hold Rate: 22.3% (September)

- Tax Revenue: $19,424 (September)

Featuring one of the smallest bettor bases in America, South Dakota is used to wild fluctuations in monthly numbers – but the 2024 roller-coaster ride was a bit jarring to even the most seasoned South Dakota sports betting enthusiast.

The state saw three months return negative gross revenue, hold and tax earnings, including a stunning February result (-$38,406 in revenue, -5.5% hold, -$3,457 in taxes). On the flip side, South Dakota also produced back-to-back 20%+ holds in August in September, helping mitigate the losses from those low points in the year.

Tennessee

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $4.6 billion | $5.9 billion | ▲ 28.7% |

| Gross Revenue | $514.1 million | $635.7 million | ▲ 23.7% |

| Hold Rate | 11.1% | 10.7% | ▼ 3.6% |

| Tax Revenue | $46.2 million | $82.3 million | ▲ 78.3% |

Monthly Highs

- Handle: $639.9 million (November)

- Gross Revenue: $82.3 million (November)

- Hold Rate: 14.7% (January)

- Tax Revenue: $11.8 million (November)

Give Tennessee sports betting full credit for weathering the October and December storms, and still coming out well ahead of last year.

The Volunteer State never saw a hold lower than 7.2% in any month, enabling it to post a double-digit rate for the third year in a row. And while it did come in slightly lower than 2023, Tennessee more than made up the difference by taking in nearly $6 billion in bets (and generating just shy of $82.3 million in tax revenue).

Vermont

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | NA | $198.8 million | NA |

| Gross Revenue | NA | $21.9 million | NA |

| Hold Rate | NA | 11.0% | NA |

| Tax Revenue | NA | $6.3 million | NA |

Monthly Highs

- Handle: $24.4 million (December)

- Gross Revenue: $4.2 million (January)

- Hold Rate: 21.1% (January)

- Tax Revenue: $1.1 million (January)

Vermont sports betting kicked off with a bang – and while there was no way it could maintain its crazy January pace, Year 1 was still highly successful overall.

The state generated nearly $200 million in handle over its first 12 months, and saw its bet tally rise every month from August through December. And while it couldn't maintain its double-digit hold pace into the fall, it did see big gains in September (13.5%) and November (11.7%).

Virginia

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $5.6 billion | $6.9 billion | ▲ 23.9% |

| Gross Revenue | $560.2 million | $685.0 million | ▲ 22.3% |

| Hold Rate | 10.0% | 9.9% | ▲ 1.0% |

| Tax Revenue | $72.3 million | $92.3 million | ▲ 27.6% |

Monthly Highs

- Handle: $761.0 million (November)

- Gross Revenue: $86.4 million (November)

- Hold Rate: 11.9% (May/July)

- Tax Revenue: $12.1 million (November)

The Virginia sports betting figures for 2024 are impressive on their own, but even more so when you consider that the state doesn't host a team in any of the four major professional North American sports leagues.

Virginia held serve on hold rate (and would have surpassed its 2023 percentage with a stronger December), while seeing nine months with more than $500 million in handle. The biggest year-over-year increase from a percentage standpoint came on the tax revenue front, highlighted by a $12.1 million showing in November.

West Virginia

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $483.2 million | $505.4 million | ▲ 4.6% |

| Gross Revenue | $47.7 million | $56.0 million | ▲ 17.3% |

| Hold Rate | 9.9% | 11.1% | ▲ 12.1% |

| Tax Revenue | $4.8 million | $5.6 million | ▲ 17.3% |

Monthly Highs

- Handle: $58.4 million (November)

- Gross Revenue: $7.6 million (September)

- Hold Rate: 15.3% (September)

- Tax Revenue: $762,138 (September)

2024 was a year of milestones for West Virginia sports betting, even if the overall handle increase didn't meet expectations.

The year saw operators in the Mountain State surpass $500 million in sports betting handle, $50 million in gross revenue and $5 million in taxes – not to mention a double-digit hold for the year after finishing oh-so-close in 2023. The most promising trend: Hold rate never dipped below 7%, even with the public dominating in October and December.

Wyoming

| Category | 2023 | 2024 | Change |

|---|---|---|---|

| Handle | $172.2 million | $209.6 million | ▲ 21.7% |

| Gross Revenue | $17.3 million | $22.8 million | ▲ 31.9% |

| Hold Rate | 10.0% | 10.9% | ▲ 9.0% |

| Tax Revenue | $1.1 million | $1.4 million | ▲ 32.3% |

Monthly Highs

- Handle: $25.2 million (December)

- Gross Revenue: $3.4 million (November)

- Hold Rate: 15.5% (July)

- Tax Revenue: $241,071 (November)

Wyoming doesn't have a major professional sports team, but it still saw significant year-over-year lift despite a clunky finish to 2024.

Wyoming sports betting proprietors saw more than $200 million in handle for the year, with July the only month to come in short of $10 million. And while hold fluctuated throughout the year (hitting an all-time low of 3.3% in December), four months saw handle finish north of 13% to lift the yearly average comfortably above 2023's 10.0% mark.