Nick Spanos takes out his phone and clicks on Google Maps to check the traffic flow on the George Washington Bridge. It’s red. Five minutes later, red again. Ten minutes later, same thing. An hour later, it’s finally green. And green means go.

The New York City resident jumps in his car and makes the 22-mile trek from his home in Queens to a Dunkin’ Donuts on the other side of the GW in New Jersey. Half a mile down Route 46, Spanos is parked next to the donut shop, fishing through his coat pocket for a small piece of paper and patiently waiting for his sports betting app to load. “Checking location," the screen reads.

A few minutes later, he's back on the road headed for home, sipping a large iced tea (with 12 Splenda) and munching on a blueberry muffin. His bets are placed and that small piece of paper, containing Spanos’ picks for the weekend, is balled up and sitting in the cup holder next to three identical balls.

This is the routine for many New York City sports bettors right now.

New Jersey Takes Bite of Big Apple Bettors

Plenty of New Yorkers can relate to Nick Spanos' aforementioned sports betting travels and travails. They drive to New Jersey, with many just like Spanos plotting out the quickest trip possible to gain access to their mobile apps, which are geofenced to ensure customers are in sports betting-legal New Jersey when making their wagers.

A boatload of revenue for sportsbook operators and tax revenue for the Garden State travel with those New York City bettors. In December 2020 alone, New Jersey sportsbooks took in a record $996.3 million worth of wagers – nearly $1 billion – and had revenue of $66.4 million, for a hold rate of 6.6 percent. That led to $7.6 million in tax revenue for the state. In total for 2020, New Jersey sportsbooks saw $6 billion in wagers and $398.5 million in revenue, leading to $50 million in tax revenue for the state. Unquestionably, New York City bettors are propping up those numbers, which are almost completely derived from mobile sports betting.

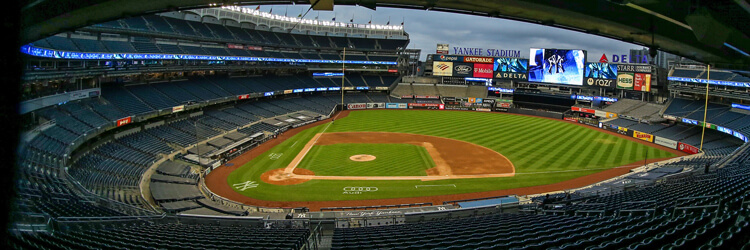

New York politicians are rightly concerned, wanting the Empire State to get its slice of the Big Apple pie, particularly in the wake of the economy-wrecking COVID pandemic. Other stakeholders certainly want the state to expand beyond its current sports betting model, which only allows for in-person wagering at four upstate commercial casinos.

The expansion of mobile sports betting – currently only allowed on-site at those four casinos, which isn't actually mobile at all – is obviously the solution. But the various interests have very different opinions on how this product should work, from Gov. Andrew Cuomo to state legislators to potential licensees to sportsbook operators and, of course, sports bettors such as Spanos.

Covers reached out to each of those stakeholders to discuss what they're seeking from New York's mobile sports betting expansion.

Cuomo's Sports Betting Proposal

To Gov. Cuomo's credit, he accurately pinpointed the reason why mobile sports betting should be widely accessible in New York. The aforementioned geographic limits on mobile betting in New York make the product practically irrelevant.

"The current online sports wagering structure incentivizes a large segment of New York residents to travel out of state to make online sports wagers or continue to patronize black markets," Cuomo said in a Jan. 6 news release. "New York has the potential to be the largest sports wagering market in the United States, and by legalizing online sports betting, we aim to keep millions of dollars in revenue here at home, which will only strengthen our ability to rebuild from the COVID-19 crisis."

However, to put it bluntly, what Gov. Cuomo doesn't want is the private sector benefiting from the expansion of mobile sports betting. The governor is in full-throated support of a state-run monopoly, so that all revenue goes to state tax coffers. He made that point in early January and, despite pushback on multiple fronts, doubled down on Jan. 19 while presenting the state's fiscal year 2022 budget.

"The question isn’t whether or not we do mobile sports betting. The question is more how, and who makes the profit. This is very lucrative," Cuomo said. "One proposal is we allow casinos to run mobile sports betting. That’s very good for casinos and the people who support casinos. The second alternative is to have the people of the state of New York actually get the profits from mobile sports betting and run it the way we run the state lottery. That’s where it’s state-run and the state gets all the revenue.

"I’m with the people. I believe the people of the state should get the revenues. This is not a moneymaker for private interests to collect just more tax revenue. We want the actual revenue from the sports betting."

That said, at least one private interest is going to make money, because the state will have to contract with an experienced sports betting operation to run its product. Still, Cuomo estimates that sports betting could eventually inject $500 million annually into state coffers, rather than $50 million if the state regulates sports betting, but allows multiple sportsbook operators in a more open market.

It's a stretch to believe that a government-run model in any business could outperform the private sector 10 times over in anything other than bureaucracy and regulatory red tape. And in sports betting specifically, it's not backed up by other U.S. jurisdictions where a government entity such as the lottery is in charge. See Washington, D.C., and Oregon, among others, for how that's working out.

And while it sounds reasonable on the surface that Gov. Cuomo wants to be with the people, private-sector involvement allows for benefits to those people that should very much intrigue the state. Those benefits include a more fair, competitive market for consumers, as well as job creation, no small matter in a state with 8.4 percent unemployment overall and more than 12 percent unemployment in New York City alone. Jobs create state and local tax revenue, too.

Legislators' Sports Betting Proposals

On the flip side of Gov. Cuomo are two New York state legislators. Like Cuomo, both are Democrats: Sen. Joe Addabbo, chairman of the Senate's Racing, Gaming and Wagering Committee; and Assemblyman J. Gary Pretlow, who chairs the Assembly's Committee on Racing and Wagering.

Pretlow represents a district just outside New York City, while Addabbo's district is in New York City. So both are familiar with the daily outflux of sports bettors from New York City to New Jersey, and both have introduced legislation to bring the state up to speed with its neighbor.

"We have opportunities here, and one of those opportunities is certainly revenue," Addabbo told Covers. "But another opportunity is job creation. That's the hope of struggling businesses in our state. Casinos, they've been decimated. This is an opportunity for job creation and saving an industry that's been very good to our state and our state's education funding."

Indeed, 80 percent of gaming industry taxes in New York go to fund education. Addabbo noted that in 2019, that amounted to $3.6 billion.

Addabbo said his proposal, Senate Bill 1183, takes into account all those who can benefit from the expansion of mobile sports betting: state and local government, casinos, tribal gaming enterprises, sportsbook operators, off-track betting facilities and more, along with of course the consumers – sports bettors.

On the competitive front, while Gov. Cuomo has stated that perhaps more than one mobile platform will be allowed, the bidding field will be limited to sports betting operators that already have partnerships with one of the state's four commercial casinos. That means, for the moment, only FanDuel (Tioga Downs Casino), DraftKings (del Lago Casino), Rush Street Gaming (Rivers Casino) and Bet365 (Resorts World Catskills) would merit consideration, and the governor's proposal could lead to the selection of just one of those four.

"Under the governor's plan, there would be one or two apps, very little competition. That's forcing New Yorkers to go to New Jersey or to do it illegally. We want to keep people here," Addabbo said, noting his bill includes each of the state's seven licensees – four active upstate licenses, three currently inactive downstate – giving each licensee two sports betting skins, meaning New York could have up to 14 sports betting operators. Furthermore, the bill invites entities such as stadiums, arenas, off-track betting sites and more to opt in by putting sports betting servers on the land of an active licensed casino.

Addabbo is convinced that the sheer volume of sports betting throughout the state would be a boon for all stakeholders. And he's just as convinced that a monopoly can't handle that volume.

"I'm a little skeptical when the state gets involved and it's a monopolistic one- or two-operator scheme," Addabbo said, noting that the legal betting jurisdictions of Oregon, Delaware, New Hampshire, Rhode Island and Washington, D.C. – all government-run – pale when compared with New York. "I actually told the governor's people, add up the population of all those. It's less than half of New York's population. We'll never be able to handle the volume."

Addabbo pointed out that the Oregon Legislature has already introduced a bill to end the state's mobile sports betting monopoly, which has far underperformed expectations. And he rightly noted that the D.C. Lottery product, despite the convenience of being entirely mobile, isn't bringing in nearly the handle or profit of the walk-up William Hill US retail sportsbook at D.C.'s Capital One Arena.

"Our bill gives a lot of authority to the Gaming Commission. But we let those who are versed in the business of gaming do the business of gaming," Addabbo said. "We want to give the state the best opportunity for residents. It's volume."

What Sportsbook Operators Want

As noted above, Gov. Cuomo could limit New York's mobile betting options to one operator, literally a monopoly, although there's also been some language allowing for more than one operator. But not many more.

Again, at the moment, only four operators – FanDuel, DraftKings, Rush Street Gaming and Bet365 – are allowed to submit proposals bidding for a state contract, because those four are the only ones to meet the qualification of having partnerships with at least one commercial casino.

That leaves out a wealth of sports betting institutional knowledge and expertise from such longtime operators as The SuperBook, BetMGM and William Hill US. It could also shut out rapidly rising relative newcomer Circa Sports and the innovative PointsBet USA, among several other sportsbook platforms/operations.

Covers reached out to several sportsbooks to get their input on Gov. Cuomo's proposal and on what they feel would be the best route for mobile sports betting in New York. However, none were willing to go on the record, understandably so. None want to say anything publicly that would jeopardize chances of potentially getting into the massive New York market, in case the framework changes to allow for greater competition.

But several sportsbook industry insiders are quite skeptical of Gov. Cuomo's plan, and not just because it squeezes out their opportunities to join a lucrative market. On background, multiple sources told Covers that a monopoly or two-operator system, run by the government, isn't good for the industry or consumers.

"A state wanting to own it and have one provider at a state level is fundamentally setting you up for a negative user experience. Failure right out of the gate," an industry insider told Covers.

Added another sportsbook source, "Everyone is upset about the proposal, but also smart enough not to voice that concern and potentially miss out later on. It's a real pickle."

Sen. Addabbo reiterated that the governor's plan eliminates job creation and the multiplier effects of said job creation. People hired for those sportsbook positions pay state and local taxes, and they purchase goods and services in support of other businesses, generating more tax revenue for the state. Having a robust open market creates a positive domino effect that recognizes long-term benefits are just as important, if not more so, than the short-term gain of a limited marketplace.

"Add up the taxes that businesses pay and that people pay, and it might eventually be more than the governor's $500 million. It's a bigger picture, job growth and maybe more," Addabbo said. "This can't be the 5-hour Energy solution. It's got to be for the long term."

Jason Logan, senior industry analyst for Covers.com, had perhaps the most intriguing take on this issue.

"Sports betting is not a piñata to be smashed open and pillaged," Logan said. Rather, he said, when sports betting is operated effectively by sportsbooks and regulated effectively by the state, it provides a consistently stable revenue stream to state tax coffers.

Off-Track Betting

As Sen. Addabbo alluded to, off-track betting operators are among those his bill aims to include, via an opt-in to sports betting. That's certainly of interest to Western Regional Off-Track Betting Corp., which operates 12 branches, along with an online advance-deposit wagering service and a telephone wagering service. The company also has 26 EZ Bet locations throughout western New York, and owns and operates Batavia Downs Gaming, which has a racetrack and video gaming facility.

To say Western Regional OTB wants in on mobile sports betting would be an understatement. Gov. Cuomo's proposal doesn't account for such wants.

"What we would reasonably like to see is mobile betting being allowed within the state, but with mobile betting companies partnering with existing physical betting locations within the state. That’s what was proposed before and what is in place currently at the various casinos that do have sports betting," Western Regional OTB president and CEO Henry Wojtaszek said. "We want to make sure that the OTBs and the gaming facilities are not left behind. Having mobile in conjunction with only the casinos that already have sports betting would put facilities like ours at a severe disadvantage, and will quicken the decline of OTB locations throughout the state.

"It makes sense to let all OTBs and casinos/gaming facilities have sports betting, as it will allow consumers a choice in where they wager and will keep many more hard-working New Yorkers employed."

Wojtaszek said his company wants the ability to partner with a sports betting company to take wagers at Western's off-track betting branches and gaming facilities. That could happen through Sen. Addabbo's opt-in plan. Further, Wojtaszek wants EZ Bet locations to have access to sports betting, which would expand even further on Sen. Addabbo's goal of benefiting a broader array of stakeholders.

"This will allow restaurant and bar owners who have EZ Bet to also reap the benefits of legal sports betting, with increased attendance and longer stays by patrons who eat and drink at those locations," Wojtaszek said. "We'd want to make sure that, no matter how the state runs mobile betting, the OTBs and gaming facilities that do not already have sports betting are not left behind."

What About N.Y. Sports Bettors?

So back to Spanos, who lives in Queens and is an avid sports bettor, as his aforementioned routine outlines. Spanos has mobile apps for five New Jersey books (the Garden State has more than a dozen providers) and he enjoys having all those outs.

If one book isn't offering odds Spanos likes or a method of betting he prefers or the ability to deposit and withdrawal with relative ease, he can take his business elsewhere from the palm of his hand.

Betting in such a competitive market provides a much better experience for consumers, who can pick and choose where and how they wager in the same way they'd pick and choose among which restaurants or grocery stores they frequent. Spanos said if the state of New York wants the sports betting customers of New York City to change their current habits, the product must induce customers to do so. And he firmly believes a state-run product won't have the desired effect.

"Anything run by the government, especially this one, would be a disaster. Businesses need the free market to survive and succeed," Spanos said. "When New Jersey first started, there was pretty much only William Hill, and they were giving $50 credits to sign up. Now, there are multiple places to bet and almost all give $1,000 to sign up. Competition creates a better experience for the customer. New York having a monopoly will lead to bad lines, lower parlay odds and everyone still flocking to New Jersey. New York needs to copy the New Jersey model, which is proven to work. If it ain't broke, don't fix it."

As is the case in New Jersey, Nevada and elsewhere, Spanos said mobile betting should be available statewide for all mobile sports betting operators. And he's on board with Western Regional's Wojtaszek in wanting sports betting at racetracks and off-track betting facilities.

Spanos' New Jersey routine certainly has its headaches, between drive time and toll fees. Plus, he enjoys in-game and second-half betting, something he can rarely partake in due to the logistics of getting bets down in New Jersey. But he stressed that the New York mobile betting product must be more than just convenient. It has to compete, in order to keep him and countless others from making that drive, or betting with their local bookies or continuing to wager with offshore operators.

"It's $30 in tolls for me to cross over, plus traffic," Spanos said. "As long as New York does something comparable to New Jersey, I don't think New Yorkers would continue to use New Jersey apps."

That's certainly a goal of Sen. Addabbo's bill. From talking with Addabbo, it's quite apparent that he's on the pro-business side, as he repeatedly stated that New York needs to prove that it's a business-friendly environment when it comes to sports betting. By extension, that shows Addabbo is very much pro-consumer on this issue, as well.

And as much as anyone else on this issue, Addabbo recognizes that you only get one chance to make a first impression with bettors.

"If you don't put out a competitive product, they will go back to Jersey or to doing it illegally," Addabbo said. "I've spoken to a range of people who are well-versed in the gaming industry of New York. I cannot find one person, other than those in this administration, who thinks the governor's plan is a good idea. Look at other states that have done it successfully. Make it accessible and easy. That's what we need."